TDHJXTNM

If you’re puzzled about what a Bank Swift Code TDHJXTNM is, let me shed some light on it. A bank swift code is a unique identification code used for international money transfers between banks. It ensures that your funds reach the intended recipient without any errors or delays. The TDHJXTNM part of the swift code refers to the specific bank and branch involved in the transaction.

In this case, TDHJXTNM is likely a placeholder or an example code, as actual swift codes consist of a combination of letters and numbers that provide detailed information about the bank, country, and location. To find the correct swift code for your bank, you can usually search online or contact your bank directly.

Understanding swift codes can be helpful when conducting international transactions or sending money abroad. By providing accurate and valid swift codes, you can ensure smooth and secure transfers across borders. So next time you come across a Bank Swift Code like TDHJXTNM, remember its importance in facilitating global financial transactions.

What is a Bank Swift Code?

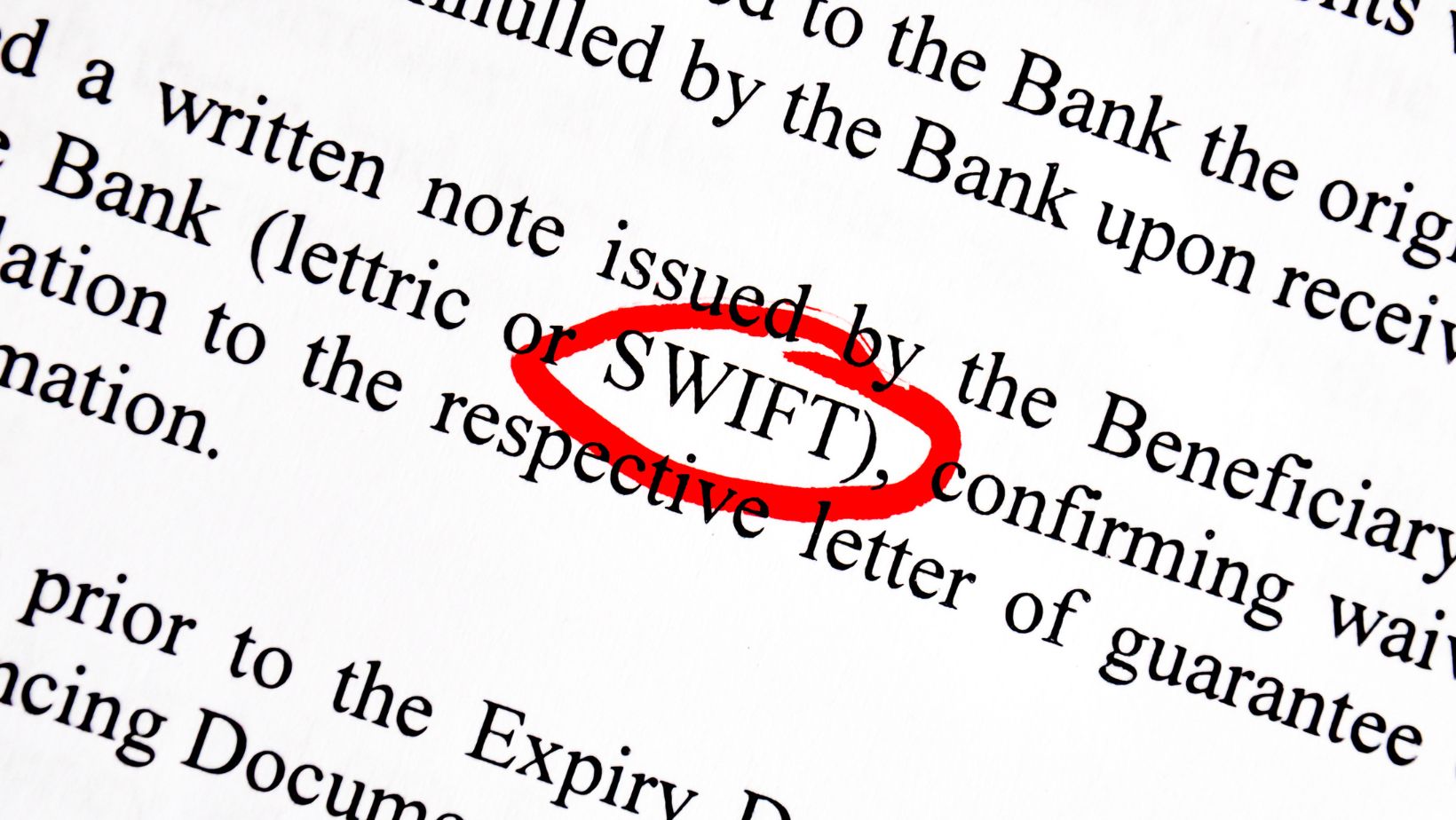

Let’s dive into the world of banking and explore what a Bank Swift Code is. A Bank Swift Code, also known as a Society for Worldwide Interbank Financial Telecommunication (SWIFT) code, plays a crucial role in facilitating international money transfers. It is an internationally recognized identification code used by banks to securely and accurately send and receive funds across borders.

So, what does this code actually represent? Each bank has its own unique Swift Code, which consists of alphanumeric characters. This code acts as an address for the bank and helps ensure that the funds are directed to the correct financial institution during transactions. Think of it as a global postal code that allows banks worldwide to communicate with one another swiftly and efficiently.

To give you a better understanding, let me provide an example: TDHJXTNM. In this case, “TDHJ” represents the bank or institution code, providing information about the specific bank involved in the transaction. The following two letters, “XT,” indicate the country where the bank is located – in this instance, it could be Xanadu (a fictional country). Finally, “NM” represents the location-specific branch identifier within that country.

Having a Bank Swift Code ensures that your money reaches its intended recipient without any hiccups along the way. Whether you’re transferring funds for personal reasons or conducting business internationally, this unique identifier helps streamline global financial transactions and enhances security.

It’s important to note that while most major banks have their own Swift Codes readily available on their websites or through customer service channels, smaller institutions might require additional assistance from their local branch or financial advisor to obtain this essential piece of information.

In conclusion, understanding what a Bank Swift Code is can greatly simplify international money transfers by ensuring accuracy and efficiency. With this globally recognized identifier at hand, you can confidently navigate through cross-border transactions knowing your funds will safely reach their destination.

Understanding the TDHJXTNM Swift Code

Understanding the TDHJXTNM Swift Code

Let’s dive into the world of banking and unravel the mystery behind the TDHJXTNM Swift Code. This unique code plays a crucial role in facilitating international transactions, ensuring that money flows smoothly between financial institutions across borders.

The TDHJXTNM Swift Code is an alphanumeric code assigned to a specific bank or branch within a bank. It serves as an internationally recognized identifier for banks, enabling quick and secure communication during cross-border transfers. Just like every individual has a unique identification number, each bank has its own distinct Swift Code.

When you initiate an international wire transfer, your bank will require you to provide the recipient’s bank’s Swift Code, including the TDHJXTNM code if it corresponds to their institution. This allows your bank to accurately route your funds to the intended beneficiary without any delays or errors.

To better understand how this code works, let me break it down for you:

- TDHJXTNM: The first four characters represent the bank’s unique code or “Bank Identifier Code” (BIC). These characters identify which financial institution the code belongs to.

- XX: The next two characters specify the country where the bank is located. For example, “US” represents the United States.

- TNM: The last three characters indicate either a specific branch within a financial institution or serve as a default location code if no branch is specified.

It’s essential to remember that each part of the TDHJXTNM Swift Code carries important information about both the receiving bank and its location. By providing this code accurately when making international transfers, you ensure that your funds reach their destination swiftly and securely.

Now that we’ve demystified this important aspect of international banking, you can confidently navigate through global transactions with ease and clarity.